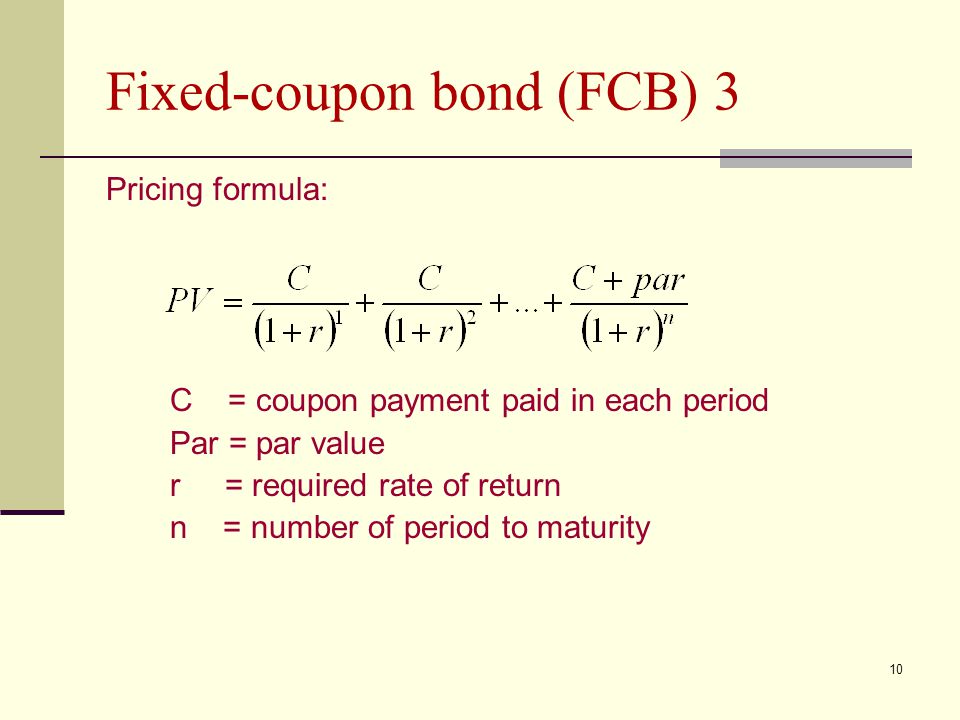

44 coupon paying bond formula

ICE BofA US High Yield Index Effective Yield - St. Louis Fed Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Excel Formulas Cheat Sheet =PRICE - calculates the price per $100 face value of a periodic coupon bond, =DB - calculates depreciation based on the fixed-declining balance method, =DDB - calculates depreciation based on the...

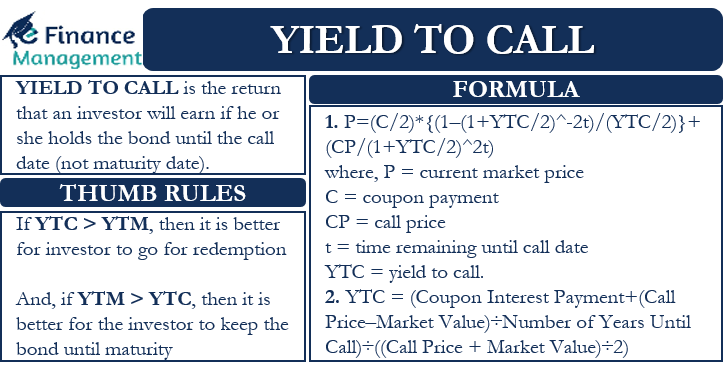

Yield to Call Calculator | Calculating YTC | InvestingAnswers The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter: "1,000" as the face value, "8" as the annual coupon rate, "5" as the years to call, "2" as the coupon payments per year, "103" as the call premium, and, "900" as the current bond price.

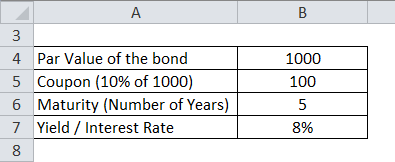

Coupon paying bond formula

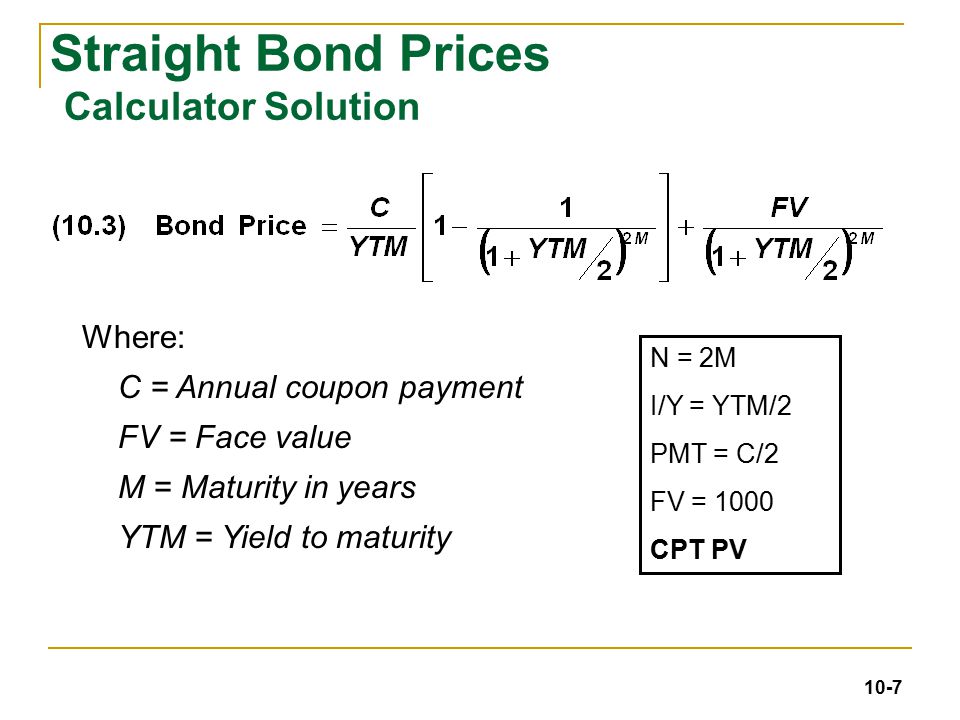

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.083% yield.. 10 Years vs 2 Years bond spread is -20.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 47.37 and implied probability of ... en.wikipedia.org › wiki › FinanceFinance - Wikipedia DCF valuation formula widely applied in business and finance, since articulated in 1938. Here, to get the value of the firm, its forecasted free cash flows are discounted to the present using the weighted average cost of capital for the discount factor. For share valuation investors use the related dividend discount model. › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

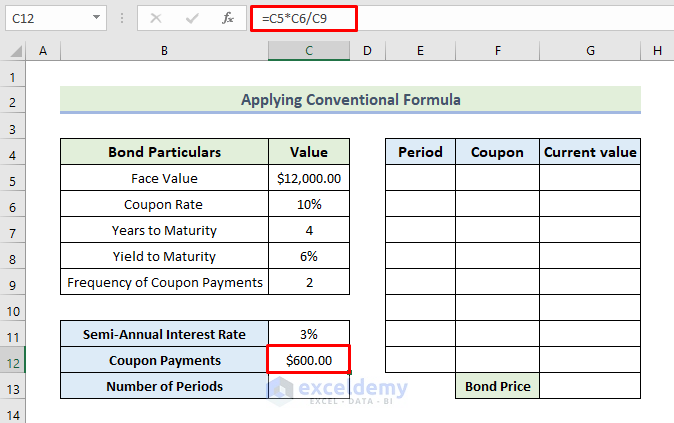

Coupon paying bond formula. Calculating U.S. Treasury Pricing - CME Group The two constitutes 2/8, or ¼, of a 1/32. A plus constitutes ½ of 1/32, and six constitutes 6/8, or ¾, of 1/32. So our bid-side quote converted from 1/32 to a decimal would be: 99-032 (1/32s) = 99.1015625, or 99.1015625 percent of par. The offer-side price would convert to 99-03+ = 99.109375. › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the ... Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia This yield is determined by taking the bond's annual interest and dividing that amount by its current market price. To make this clear, consider this simple example: a $1,000 bond that sells for... Accounts That Earn Compounding Interest | The Motley Fool Compound interest formula, Let's go over the compound interest formula and define each of the variables. P (1 + R/N)^ (NT) = A, Principal: P is the investment or principal balance at the start of...

Another milestone: The yield advantage for EE Savings Bonds has ... Back in 1992, EE bonds paid 6% a year and were guaranteed to double in 12 years. After 12 years, they reverted to paying 4% a year to maturity. In March 1993, the doubling term was adjusted to 18 years. In May 1995, it was adjusted tp 17 years. In June 2003, it was brought to 20 years, where it has remained. What the Treasury needs to do, Premarket stocks: The bond market is crumbling | CNN Business Vanguard's $514.5 billion Total Bond Market Index, the largest US bond fund, is down more than 15% so far this year. That puts it on track for its worst year since it was created in 1986. The ... What are government bonds? How the gilt market works, who can buy them ... Financial services company IG explains: "Say, for instance, that you invested £10,000 into a 10-year government bond with a 5 per cent annual coupon. Each year, the government would pay you 5 per... Bond Formula | How to Calculate a Bond | Examples with Excel … Relevance and Use of Bond Formula. From the perspective of an investor or an analyst, it is important to understand the concept of bond pricing as bonds are an indispensable part of the capital market. In the bond market, bonds paying higher coupons attractive for investors as a higher coupon rate means higher yields. Further, bonds that trade ...

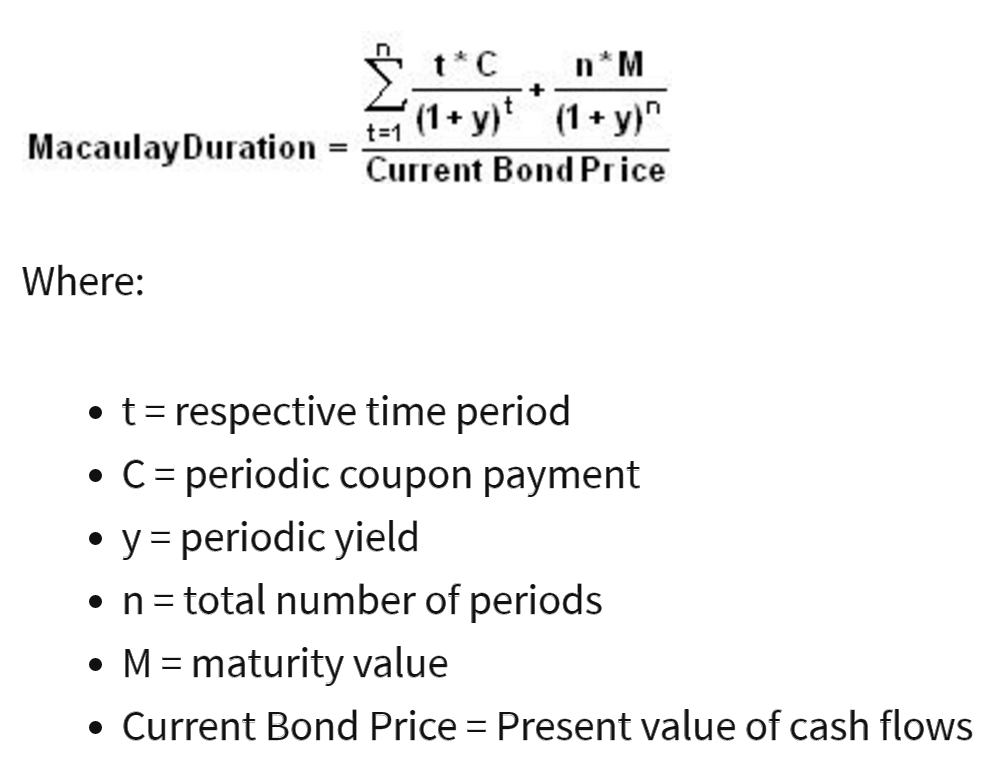

Macaulay Duration - Investopedia With the periods and the cash flows known, a discount factor must be calculated for each period. This is calculated as 1 ÷ (1 + r) n, where r is the interest rate and n is the period number in... Zero Coupon 2025 Fund | American Century Investments Each Zero Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity. Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity. Understanding Default Risk in Bond Investing - SmartAsset Default risk in bond investing refers to the chance that a bond-issuing company or government would fail to make its debt and interest payments. As a bond investor, you can lose 100% of your investment along with uncollected interest. But there are several steps you can take to hedge against default risk. Coupon Printer - Printable Coupons and Deals 20% off BISSELL Formulas, $5.00 off GilletteLabs Exfoliating Labs Razor OR Blade Refill, $6.00 off Crest 3D White Strips, $3.00 off Laundry Scent Booster, $2.00 off Bounty Paper Towel Rolls 16ct, 25% off Culturelle Daily Probiotic Capsules, $3.00 off Oral-B Glide Floss,

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

› ask › answersAccrued Interest and the Bond Market - Investopedia Jun 29, 2021 · If a bondholder sells this bond on Oct. 1, the buyer receives the full coupon payment on the next coupon date scheduled for Dec. 1. In this case, the buyer must pay the seller the interest accrued ...

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

U.S. Treasury Bond Overview - CME Group Time & Sales. Specs. Margins. Calendar. US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading.

Accrued Interest: Definition and How to Calculate | The Motley Fool The formula is $10,000 x .05 / 12 = $41.67. This means you have $83.33 of accrued interest. Make sure when you sell the bond that you take that number into account. Conclusion, In all investing, it...

How to calculate interest earned on a savings account n = your bank compounds monthly, so it would compound 12 times a year. t = you are looking to find your interest earned of 1 year. Then plug it into the equation: A = 1,000 (1+ .01/12) (12 X 1) And finally, type the equation into a calculator—or use a pencil and paper if you'd like—to get your total amount of $1,010.05.

Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond …

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.837% yield. 10 Years vs 2 Years bond spread is -44.6 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

iShares® iBonds® 2022 Term High Yield and Income ETF | IBHB Get exposure to a diversified universe of high yield and BBB-rated corporate bonds maturing between January 1, 2022 and December 15, 2022 in a single fund. 2. Designed to mature like a bond, trade like a stock. Combine the defined maturity and regular income distribution characteristics of a bond with the transparency and tradability of a stock. 3.

91 Day T Bill Treasury Rate - Bankrate 91-day T-bill auction avg disc rate. 3.08. 2.61. 0.05. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a discount ...

Accrued Interest and the Bond Market - Investopedia 29.06.2021 · If a bondholder sells this bond on Oct. 1, the buyer receives the full coupon payment on the next coupon date scheduled for Dec. 1. In this case, the buyer must pay the seller the interest accrued ...

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and therefore owes a debt to the purchaser of the bond.

What Is Time Value Of Money - Formula & Calculations | ELM - Elearnmarkets The PV of a sum of money can be used to determine the current value of projected cash flow from a bond, an annuity, a loan, or any such instance where you are supposed to receive money from a third party in the future and you want to know exactly how much that money will be worth today. It is given by the following formula -, PV = FV / (1 + i)^n,

Treasury Bills | Constant Maturity Index Rate Yield Bonds ... - Bankrate Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Overseas Baby-Formula Makers Given Path to Keep Selling in U.S. Sept. 30, 2022 1:50 pm ET. Listen to article. (2 minutes) Federal health regulators outlined plans Friday that will allow overseas baby-formula makers to continue selling their products in the U.S ...

Annualized Rate of Return Formula | Calculator - EDUCBA Let us take an example of an investor who purchased a coupon paying a $1,000 bond for $990 on January 1, 2005. The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment.

Daily Treasury Yield Curve Rates - YCharts Japan Government Bonds Interest Rates: Oct 2 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Oct 2 2022, 19:50 EDT: Euro Short-Term Rate: Oct 3 2022, 02:00 EDT: Spain Interest Rates: Oct 3 2022, 04:00 EDT: European Long Term Interest Rates: Oct 3 2022, 04:00 EDT: Secured Overnight Financing Rate Data: Oct 3 2022, 08:00 EDT: Bank of America ...

Credit Suisse X-Links Crude Oil Shares Covered Call ETNs - MarketBeat When was Credit Suisse X-Links Crude Oil Shares Covered Call ETNs's most recent dividend payment? Credit Suisse X-Links Crude Oil Shares Covered Call ETNs's most recent monthly dividend payment of $2.53 per share was made to shareholders on Monday, September 26, 2022.

How to Calculate IRR (Internal Rate of Return) in Excel (8 Ways) Then, select Cell D6 and insert the following formula. =C6/ (1+$C$13)^B6, After that, press ENTER and drag down the Fill Handle tool to AutoFill the formula for the rest of the cells. Now, you will get all the values of the Present Value. Then, select Cell D11 and insert the following formula. =SUM (D6:D10)

› annualized-rate-of-return-formulaAnnualized Rate of Return Formula | Calculator | Example ... Let us take an example of an investor who purchased a coupon paying a $1,000 bond for $990 on January 1, 2005. The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment.

219 Best Monthly Dividend Stocks for 2022 - MarketBeat.com Their stock also costs $50 per share. To calculate the dividend yield, you would simply divide the announced per share annual dividend by the share price. Simply put, investing $10,000 in Company A would produce $752.50 of annual dividend income or $62.70 of monthly dividend income if they pay monthly.

How to Calculate Dividend Yield - SmartAsset Here's the dividend yield formula in simple terms: Dividend Yield = Annual Dividends Per Share ÷ Current Share Price. Here's an example of how to calculate dividend yield. Let's say that the annual dividend per share for Company A is $6, and its current share price is $270. When we plug these numbers into the formula, it looks like this:

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

en.wikipedia.org › wiki › FinanceFinance - Wikipedia DCF valuation formula widely applied in business and finance, since articulated in 1938. Here, to get the value of the firm, its forecasted free cash flows are discounted to the present using the weighted average cost of capital for the discount factor. For share valuation investors use the related dividend discount model.

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.083% yield.. 10 Years vs 2 Years bond spread is -20.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 47.37 and implied probability of ...

Post a Comment for "44 coupon paying bond formula"