44 yield to maturity of a coupon bond formula

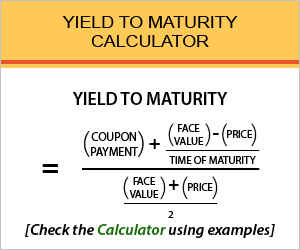

Yield to Maturity (YTM) | Definition, formula and example Yield to maturity can also be calculated using the following approximation formula: YTM =. C + (F − P)/n. (F + P)/2. Where C is the annual coupon amount, F is the face value of the bond, P is the current bond price and n is the total number of years till maturity. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating ...

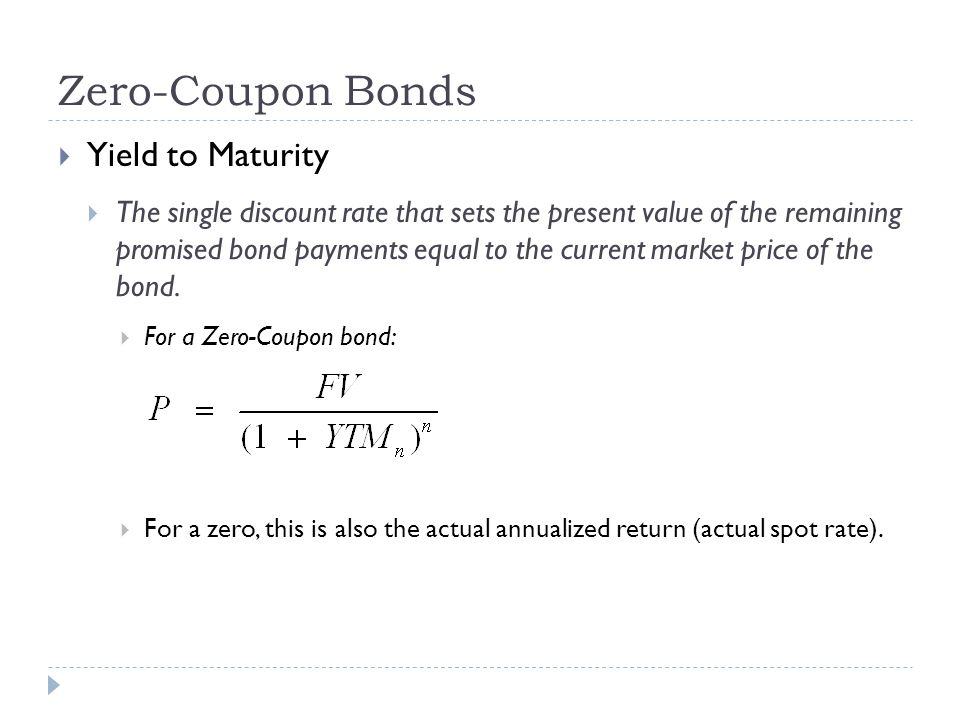

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to maturity of a coupon bond formula

Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%. Yield to Maturity Formula: How to Calculate YTM/Book Yield on a Bond The expected yield to maturity is 7.9% annually. Example 2. Assume you want to buy a zero-coupon bond and want to evaluate what YTM of this bond would be. The Face Value of the bond is $1,000. The Price of the bond is $865. There are 2 years until the maturity. The yield to maturity of this zero-coupon bond is 7.52%. Yield to maturity calculator - xie.graoskiny.pl P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity . Let's take an example to understand how to use the formula. Let us find the yield - to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9.

Yield to maturity of a coupon bond formula. How to calculate yield to maturity in Excel (Free Excel Template) Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond... Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM. Mathematically, the formula for bond price using YTM is represented as, Bond Price = ∑ [Cash flowt / (1+YTM)t] Where t: No. of Years to Maturity Yield to Maturity(YTM): Definition, Formula & Calculation - ET Money Yield to maturity Formula There is a formula to calculate the approximate value of yield to maturity, which is- Where: Annual coupon rate = Coupon for Bonds Market price refers to the current price of the bond Years to maturity can be calculated by taking the number of years remaining from the maturity date 5. How to Calculate Yield to Maturity?

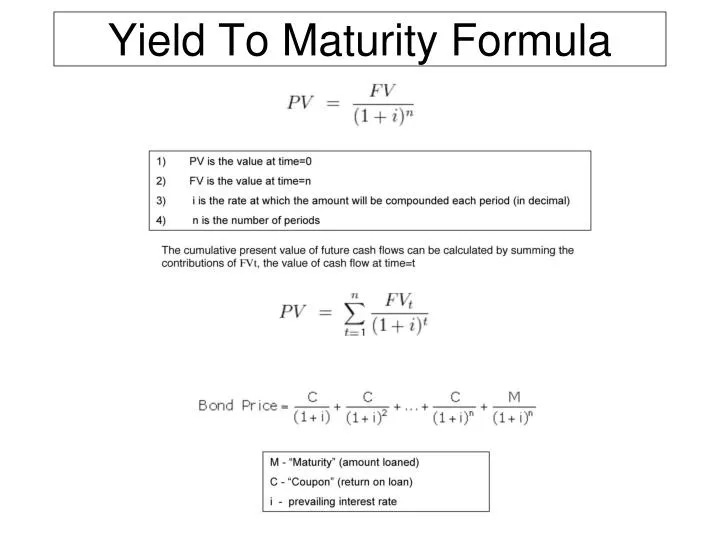

Python - yield to maturity (finance - bonds) - Stack Overflow I am trying to calculate the yield to maturity for bonds (working in Google Colab (Jupyter)). The mathematical formulation of the problem is: with price = $1276.76, number of periods = 60 [0.5 years] = 30 years, payment per period = $40 and final payment (par value) = $1000 and interest rate = r. goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... › Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ). Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

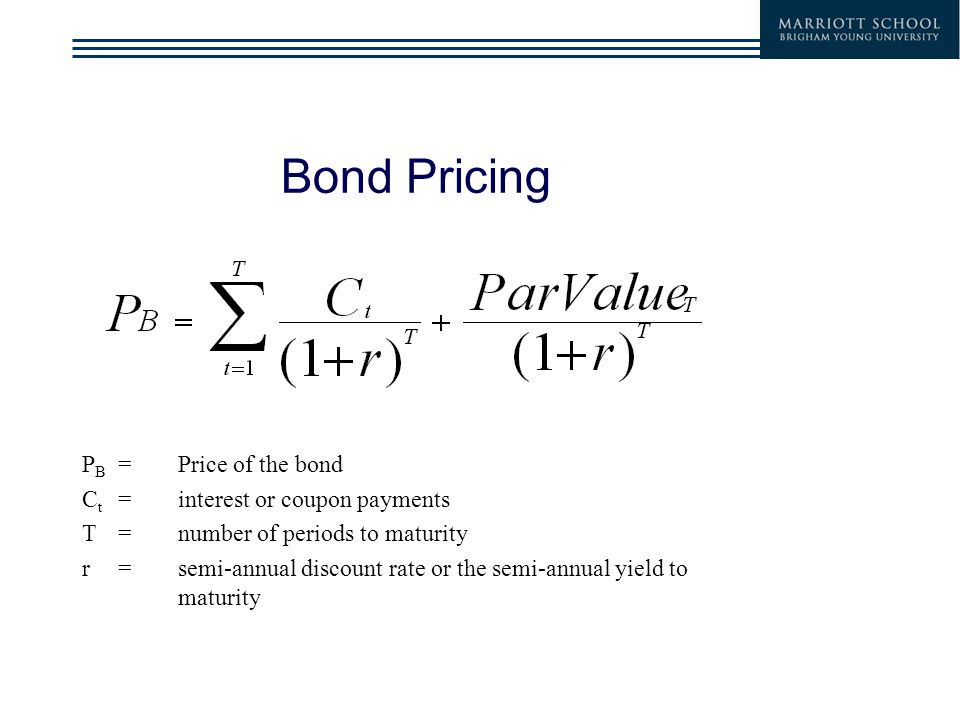

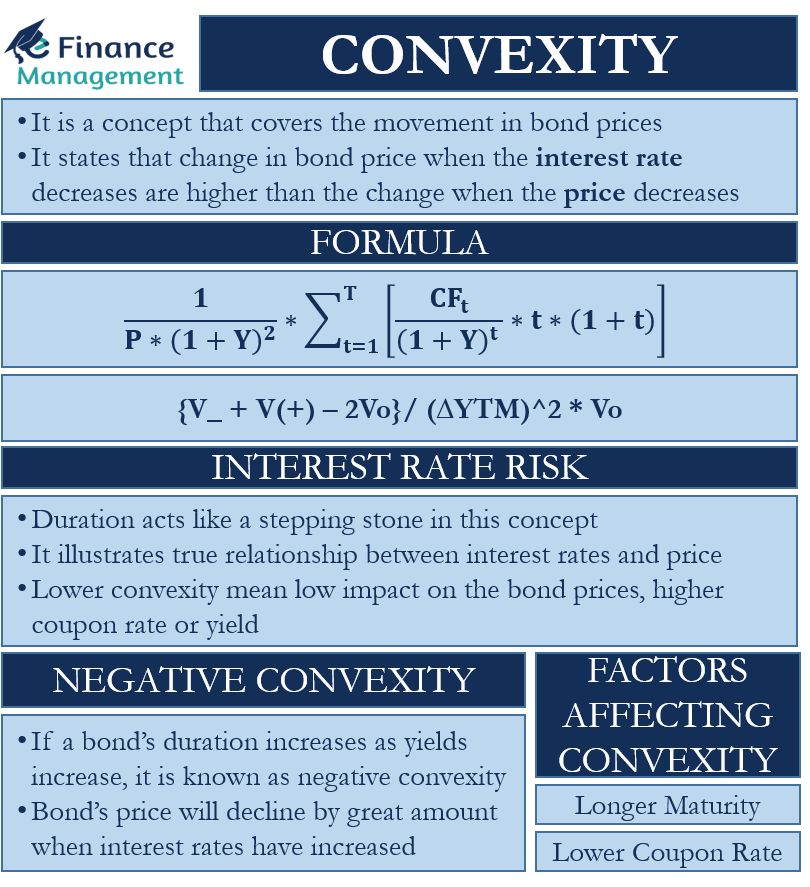

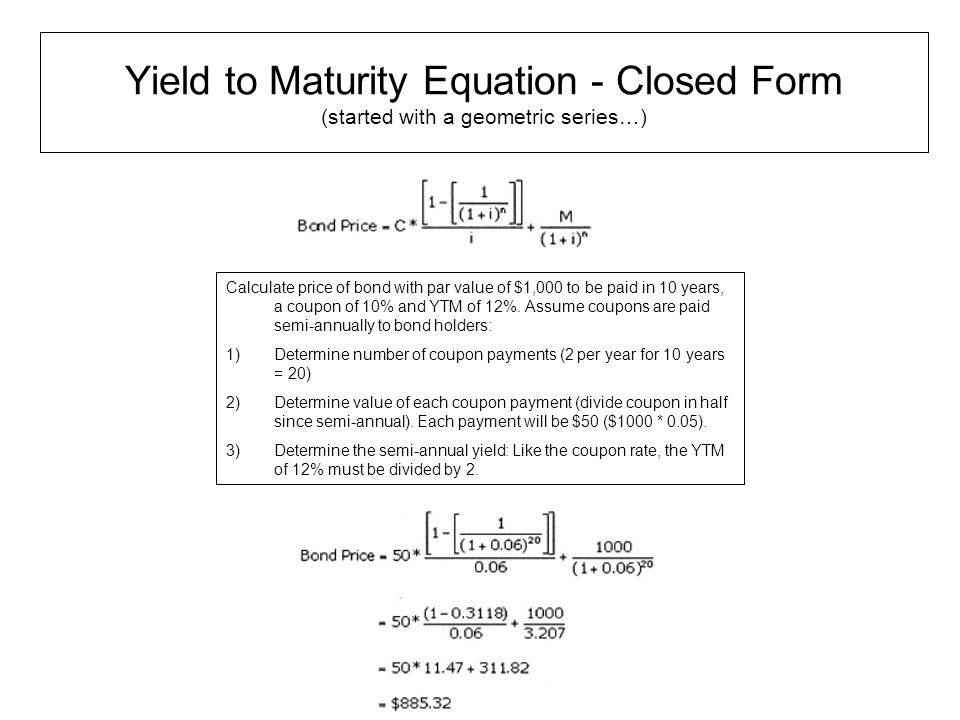

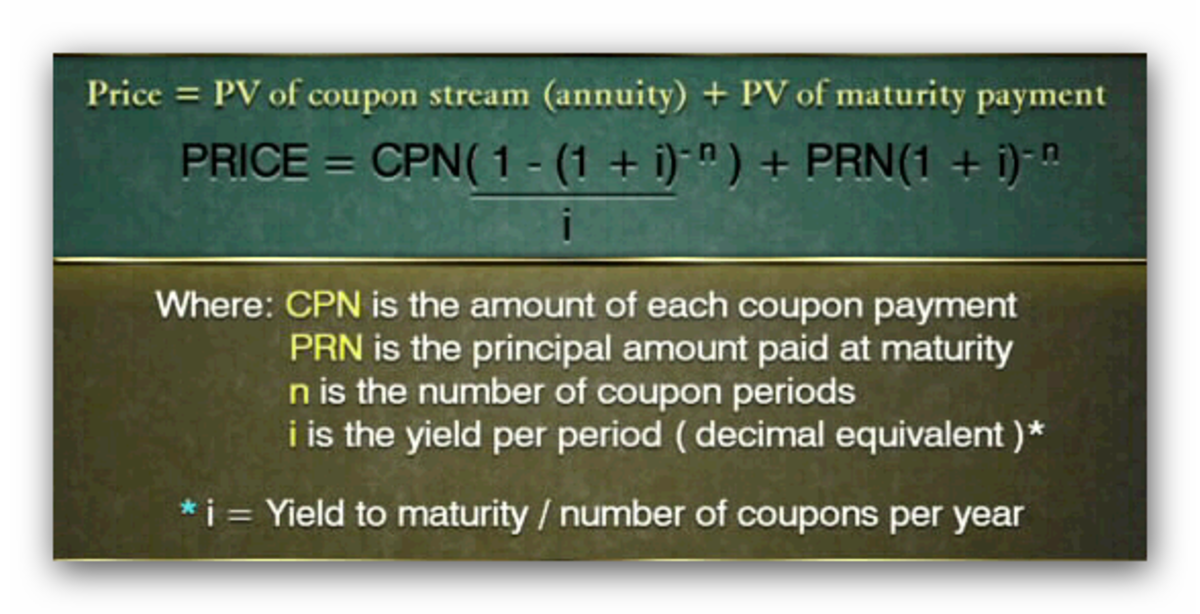

Yield to Maturity (YTM): Formula, Meaning & Calculation - ET Money Blog In the case of a Bond, YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. The YTM formula for a single Bond is: Yield to Maturity = [Annual Interest + { (FV-Price)/Maturity}] / [ (FV+Price)/2] In the above formula, Annual Interest = Annual Interest Payout by the Bond. Bond Yield to Maturity (YTM) Calculator - DQYDJ Coupon Frequency: 2x a Year 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25% What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did we find that answer? › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table. You may also have a look at the following articles – Coupon Rate and Interest Rate; Calculation of Convexity of a Bond; Bond Equivalent Yield; Zero-Coupon Bond Formula Coupon Bond Formula | Examples with Excel Template - EDUCBA Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity

Understanding the Yield to Maturity (YTM) Formula | SoFi Here's an example of how to use the YTM formula. Suppose there's a bond with a market price of $800, a face value of $1,000, and a coupon value of $150. The bond will reach maturity in 10 years, with a coupon rate of about 14%. By using this formula, the estimated yield to maturity would calculate as follows:

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

› terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Yield to maturity formula The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. BOND YIELD CALCULATION. Assume for example that you wanted to determine the ...

Yield to Maturity Formula & Examples | How to Calculate YTM - Video ... There are various styles of calculating investment returns using a yield to maturity formula. ... Here is an example of a $100 zero-coupon bond with a two-year maturity date, and the current value ...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents

Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Yield to Maturity (YTM) Approximation Formula - Finance Train P = Bond Price C = the semi-annual coupon interest N = number of semi-annual periods left to maturity Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9.87%.

corporatefinanceinstitute.com › resourcesYield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity. The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different ...

› terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Yield to Maturity (YTM): Formula and Calculator [Excel Template] If the YTM = Coupon Rate and Current Yield → The bond is said to be "trading at par". Drawbacks to Yield to Maturity (YTM) The most noteworthy drawback to the yield to maturity (YTM) measure is that YTM does NOT account for a bond's reinvestment risk.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Yield to maturity calculator - xie.graoskiny.pl P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity . Let's take an example to understand how to use the formula. Let us find the yield - to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9.

Yield to Maturity Formula: How to Calculate YTM/Book Yield on a Bond The expected yield to maturity is 7.9% annually. Example 2. Assume you want to buy a zero-coupon bond and want to evaluate what YTM of this bond would be. The Face Value of the bond is $1,000. The Price of the bond is $865. There are 2 years until the maturity. The yield to maturity of this zero-coupon bond is 7.52%.

Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%.

![Bond Yield: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/11180917/Bond-Yield-Metrics-e1644621656277.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

![Yield to Call (YTC): Bond Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/03225111/Yield-to-Call-YTC-Formula.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

Post a Comment for "44 yield to maturity of a coupon bond formula"